Bullion

Bullion is the oldest form of Money. Often referred to as God's money as it can never be created and the supply is limited. Bullion is the best bet against inflation. With the Fiat regime, the real purchasing power decreases as inflation rises. To protect against that Bullion is purchased. The best way to buy Bullion is via GOI Gold Bonds. However one can also prefer Goldbees or a physical Gold bar as per one's appetite.

Stocks

These are units of companies listed on the national stock exchange. This is a way to invest in companies and be a part of the business. The best form of investment is to bet on Top 100 companies often referred to as BLUECHIPS. We advise that anyone who is not an active investor in stock markets can buy Nifty Bees (Top 50) and Junior Bees (51-100) for long term wealth creation.

Invits/REITS

Real estate investment trusts (REITs) and infrastructure investment trusts (InvITs) are innovative vehicles that allow developers to monetise revenue-generating real estate and infrastructure assets, while enabling investors or unit holders to invest in these assets without actually owning them.The money raised through the fund can be used only to buy infrastructure assets – equity or debt. Of the total assets bought, the fund is required to invest at least 80% in a revenue generating infrastructure asset.

The rest can be invested in under-construction infrastructure asset or securities of infrastructure companies. The cashflows that the InvIT receives (90% of it after expenses), needs to be given out to the shareholders every six months.

Moreover, the InvIT price can move up in the market, offering a capital appreciation. While capital gains tax is taxed at 15% for holding below 3 years (short term capital gains) and 10% for above 3 years (long term capital gains). Its a decent bet but only to investors who understand the model completely and are well versed with risks.

FD/Bonds

This is self explanatory product and one which is common among investors. GOI Bonds are the safest bet with low returns.

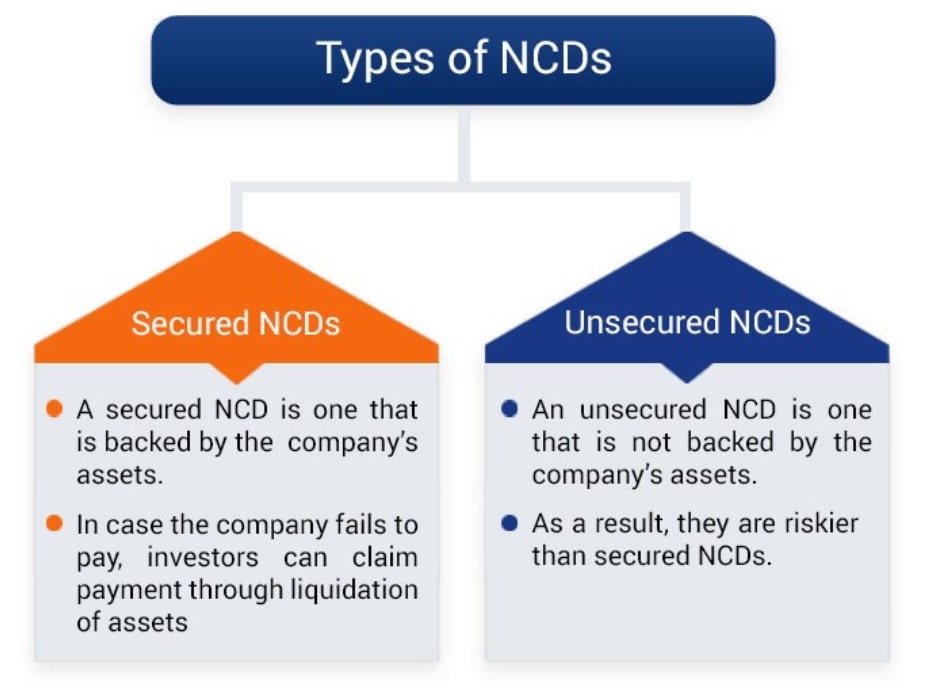

NCDs

Non-convertible debentures(NCDs) are a financial instrument that is used by companies to raise long-term capital. This is done through a public issue. NCDs are a debt instrument with a fixed tenure and people who invest in these receive regular interest at a certain rate. When compared to other fixed income instruments, NCDs offer higher returns to the investor. In addition, NCDs can be a good way to diversify your portfolio. Again every investment have risks attached, so please understand the same and invest.

P2P lending

This is a very new form of investment with controlled risk and lucrative returns. Its based on the concept of removing the middleman (banks) and directly connect the investor and the borrower. There are many P2P websites now in India. Again subscribe to any only if you understand the in and out of this investment.

Crypto Assets

Crypto is a digital asset designed to work as a medium of exchange wherein

individual coin ownership records are stored in a ledger existing in a form of a

computerized database using strong cryptography to secure transaction records, to control

the creation of additional coins, and to verify the transfer of coin ownership. It typically

does not exist in physical form (like paper money) and is typically not issued by a central

authority.

In order to understand more on this please contact us.